P>Welcome, my name is Eric Rhine. I retired from the Marines in 2012 and along the way, I had experiences that nobody in tap class or any transition speaker had really prepared me for. I built this lecture specifically to address one of those experiences, which deals with the federal tax system and what might happen to you as a transitioning retiring military member during the first years after your retirement. This presentation is about the federal tax considerations for you as a military retiree, specifically in your first couple of years and why you might have a large tax liability when you go to file your taxes in the spring in the first one to two years after you retire. So the issue after your retirement, you may be shocked when you go to file your taxes and have a very large deficit that you have to pay in the spring. Let's look at the contributing factors to that and maybe some solutions. The loss of the benefits that come with your allowances, specifically your housing allowance, is a big factor. The fact that you'll probably make more money will obviously increase your tax liability, but that's not the main cause we're talking about here. The effect of your withholding plays a role in that tax liability, and the root cause issue is the progressive tax rates that will cause a large tax liability for you as a retiree when you go to file. And then, we'll look at some potential solutions. The first thing I want to point out is the tax advantage you receive with your military allowances, specifically the Basic Allowance for Housing (BAH). This is also true for the Basic Allowance for Subsistence (BAS). If you ever look at your statement of military compensation, you'll see that...

Award-winning PDF software

Military annuitant definition Form: What You Should Know

Payment of a deceased veteran's pension, in person If you receive military survivor, pension or annuity pay from you former or former spouse, you must present your pension to the Veterans Administration office where you filed your separation statement. If, due to the failure of the employer to comply with federal law, the military portion is withheld, you can make a payment to the United States Army in order to cover the difference. Payment of a Veteran's Death Benefit — United States Department of Veterans Affairs If you are receiving military survivor or death benefits on your military retirement, and you are already the beneficiary of a military retirement annuity, you may also apply to the VA if you are eligible to retire. An individual can make an application in person to the Office of Retirement Benefits, located at 2115 West Globe Road, Arlington TX 75003 or by phone at, or by mail-to: Army Retirement Pay, PO Box 1615, Ft. Beauvoir, VA 22030 DAD (Military Affiliation Dependent) Dependents Pay (DAD) Annuitants Pay (DADA) Annuitants that are dependent on service, and who do not have a “dependent” pay receipt on file must file an annuitant's DAD Application to make an annuity payment. If you are a dependent, and you qualify for DAD, you should submit your application to the Army Pension Command for processing. In accordance with section 1201(b)(1) of title 10, United States Code, each dependent of a member of the Armed Forces is entitled to the special military retirement pay or the special military annuity. The date that the DAD application is received by the Command is the first date the Service Record will be considered. The date the DAD application is received by the Command is the first date that a full payment will be made. The DAD application is considered to be processed when it is completed in accordance with this schedule. DAD Application Receipt Number If your DAD application is received prior to the first date that a full payment will be made, a payment will be made by the next check on the next calendar week.

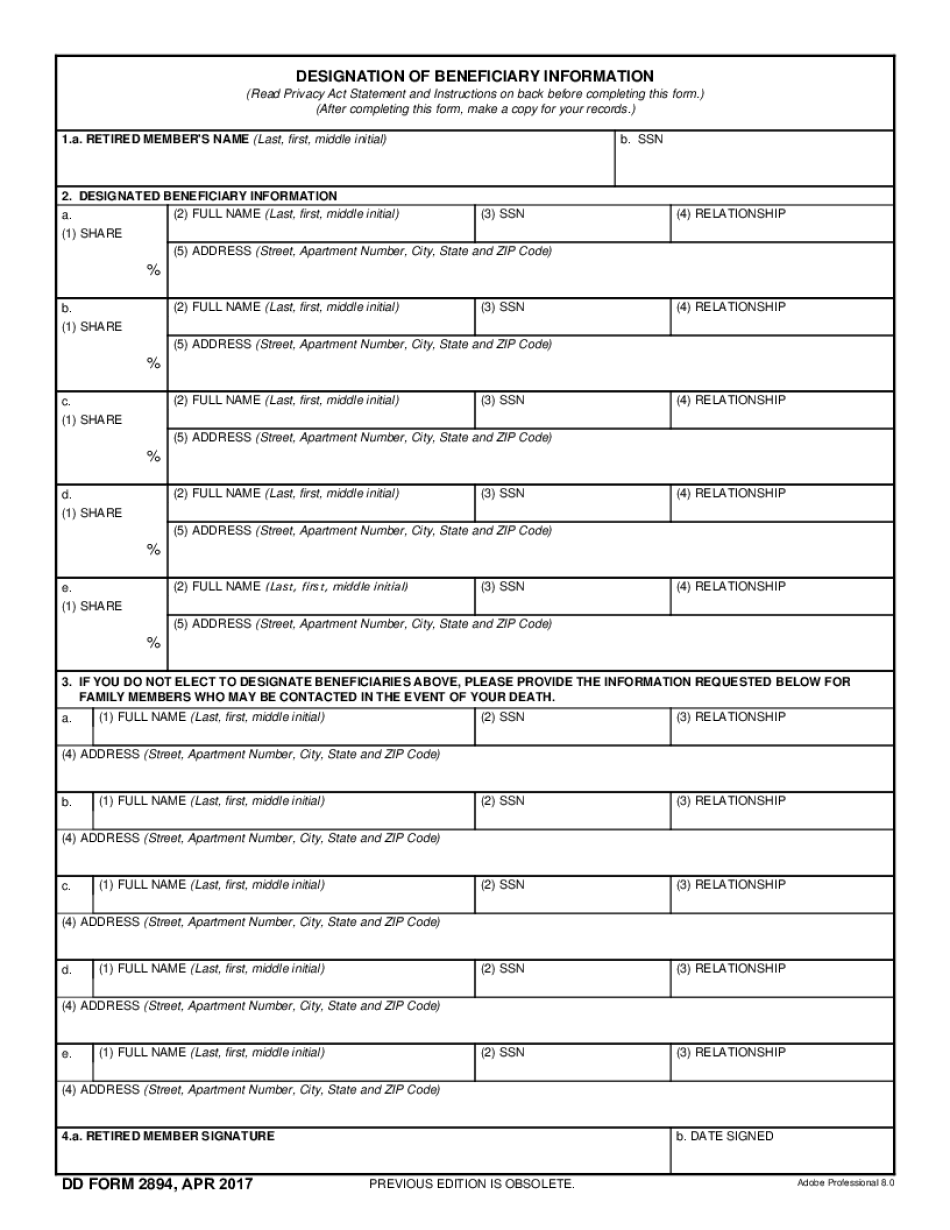

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd Form 2894, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd Form 2894 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd Form 2894 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd Form 2894 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Military annuitant definition